客観性に乏しい、世界の株価の動き

客観性に乏しい、世界の株価の動き

20年以上、世界の株価の変動を見ているが、最近の世界の株価の情勢は、

かなり、いびつなものになっている気がしてならない。

米国に世界のあふれんばかりの緩和マネーが、投入されて、

近年まれに見る上昇。

欧州に目を向けてみると、あれだけ、テロとか、英国のEU離脱とか、

ギリシャ問題(EU域内の経済格差)あっても、順調に上昇している。

下がると見られた、英国が、一番に上昇している。

日本は、あいかわらず、海外勢の、売買にふられて、上げたり下げたり、

米国、欧州に比べては、上昇が鈍い。中国は、表に出てくる情報が

少なかったり、信頼性も低い。

もともと、経済は、国の政治力に比例して、

その強さが決まると言われている。

しかし、最近はその傾向が非常に強い様に思う。

世界情勢で、世界の株価が動くはずなのに、その動きが意図的、

コンロールされている気がしてならない。

富裕層にやさしい、トランプ大統領になってから、特に、

その傾向が強い様に思う。

米国では、多額の借金をして、大学進学、家や別荘、車、クルーザー船、

プライベートジェットを買っているようです。

その信用と担保は、個人の資産

(株、債券、家、車、船、飛行機・・)です。

ですから、もし、大きなバブル崩壊があれば、経済が根底から崩れて

いくのです。そういう事がないように、FRBが、

経済の舵取りをしてるのかもしれませんね。

それに、乗っかろうとして、背伸びした、偽の富裕層が、

無理して、多額の借金をする事をサブプライムローンと言う。

最近のバブル崩壊の多くは、これが原因のようです。

バブル崩壊から、立ち直るために、また、意図的なバブルをつくり、

また、バブル崩壊の繰り返しである。

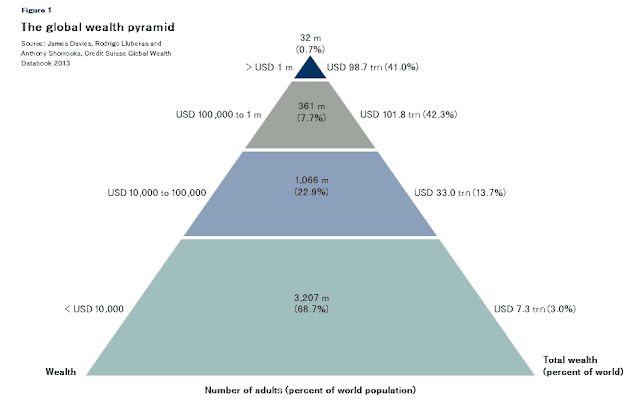

世界の富の集中も、意図的につくられたものかもしれない。

富めるものは益々、その富を更に増やし、貧しい人々は、

益々貧しく、世界全体で数千万人、いや、数億人かもしれない

飢餓に瀕してる人間が存在してるのが、現実です。

世界の環境も危機的状況になっているが、経済も同じ

状態になっているのかもしれませんね。

Lack of objectivity, global stock price movements

Although we are seeing changes in the stock price of the world for over 20 years, the situation of the stock price of the world recently,

It feels pretty awful, it feels bad.

The world's eccentric mitigation money has been introduced into the United States,

Rising seen rarely in recent years.

Looking to Europe, there are such things as terrorism, Britain's withdrawal from the EU,

Even with the Greek problem (economic disparity within the EU),

it is steadily rising.

It was seen as going down, the UK is rising the most.

As Japan continues to be raised and lowered, buying and selling overseas,

The rise is slow compared to the US and Europe. In China, the information appearing in the table

It is low and reliability is low.

Originally, the economy, in proportion to the political power of the country,

It is said that its strength will be decided.

However, recently I think that trend is very strong.

In the world situation, the stock price of the world should move,

but the movement is intentional,

I feel like being controlled.

Especially for wealthy people, since becoming the playing cards president, in particular,

I think that tendency is strong.

In the United States, you have to pay a lot of debts, go on to university, house and villa, car, cruiser ship,

It seems to be buying a private jet.

Its credit and collateral are personal assets

(Stocks, bonds, houses, cars, boats, planes ...).

So, if there is a big bubble collapse, the economy will collapse

from the ground

I will go. As there is no such thing,

Perhaps it is steering the economy.

Besides, a fake wealthy class who stretched out trying to ride,

To forcibly make a lot of debts is called subprime loan.

Many of recent collapse of the bubble seems to be caused by this.

In order to recover from the collapse of the bubble, and to create intentional bubbles,

It is also a repetition of the collapse of the bubble.

The concentration of wealth in the world may also be intentionally created.

More rich will more and more increase its wealth, poor people,

Even more poor, tens of millions people worldwide, no, maybe hundreds of millions

It is the reality that there are human beings in hunger.

The environment of the world is also in a crisis situation, but the economy is the same

It may be in state.

状態になっているのかもしれませんね。

Lack of objectivity, global stock price movements

Although we are seeing changes in the stock price of the world for over 20 years, the situation of the stock price of the world recently,

It feels pretty awful, it feels bad.

The world's eccentric mitigation money has been introduced into the United States,

Rising seen rarely in recent years.

Looking to Europe, there are such things as terrorism, Britain's withdrawal from the EU,

Even with the Greek problem (economic disparity within the EU),

it is steadily rising.

It was seen as going down, the UK is rising the most.

As Japan continues to be raised and lowered, buying and selling overseas,

The rise is slow compared to the US and Europe. In China, the information appearing in the table

It is low and reliability is low.

Originally, the economy, in proportion to the political power of the country,

It is said that its strength will be decided.

However, recently I think that trend is very strong.

In the world situation, the stock price of the world should move,

but the movement is intentional,

I feel like being controlled.

Especially for wealthy people, since becoming the playing cards president, in particular,

I think that tendency is strong.

In the United States, you have to pay a lot of debts, go on to university, house and villa, car, cruiser ship,

It seems to be buying a private jet.

Its credit and collateral are personal assets

(Stocks, bonds, houses, cars, boats, planes ...).

So, if there is a big bubble collapse, the economy will collapse

from the ground

I will go. As there is no such thing,

Perhaps it is steering the economy.

Besides, a fake wealthy class who stretched out trying to ride,

To forcibly make a lot of debts is called subprime loan.

Many of recent collapse of the bubble seems to be caused by this.

In order to recover from the collapse of the bubble, and to create intentional bubbles,

It is also a repetition of the collapse of the bubble.

The concentration of wealth in the world may also be intentionally created.

More rich will more and more increase its wealth, poor people,

Even more poor, tens of millions people worldwide, no, maybe hundreds of millions

It is the reality that there are human beings in hunger.

The environment of the world is also in a crisis situation, but the economy is the same

It may be in state.

コメント